Accrual/Deferral Document Method

On the month end provision are made and on the next month first working day, we reverse total provisions made. At the time of making payment we take the actual payment made.

Steps:

1) Creation of reversal reason

2) Enter accrual/deferral documents

A. Rent Provision

B. Salary Provision

3) Reversal of accrual/deferral documents

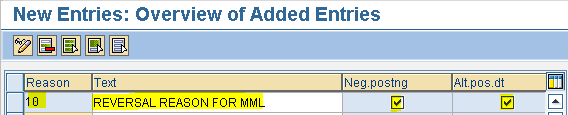

Creation of Reversal Reason

Path: SPRO - Select Sap Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Adjustment Posting/Reversal - Define Reasons for Reversal

Step 1) Select the New Entries button

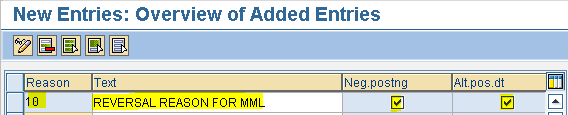

Step 2) Populate the following fields : Reason, Text, Negative Posting and Alternate Posting date

Why we select negative posting check box?

When we reverse provision on the 1st of next month, it shows on debit side as negative balance instead of credit side

Why we select alternative posting date check box?

If we do not select the alternative posting check box, system will allow us to reverse only on original posting date. If we select the check box, it allows reversal entry on any date.

Ex:

Provision - 30/02/2018 (original posting date)

Reverse - 01/03/2018

Step 3) Select save button or Ctrl + S

Save in your request

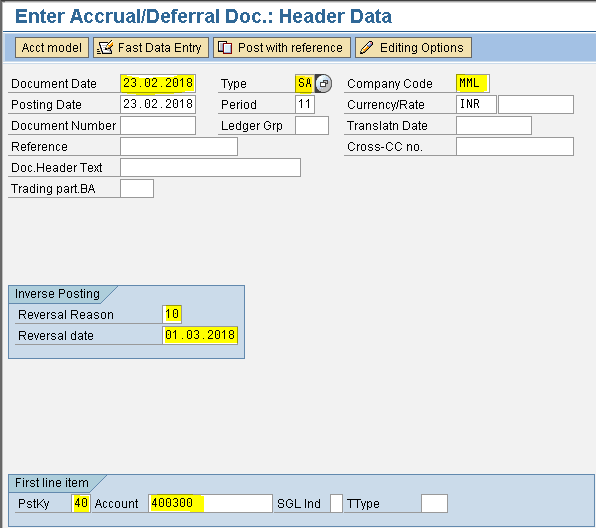

Creating Accrual/Deferral Documents

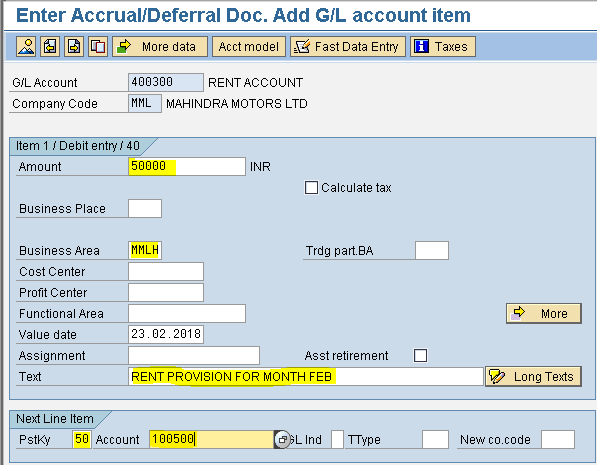

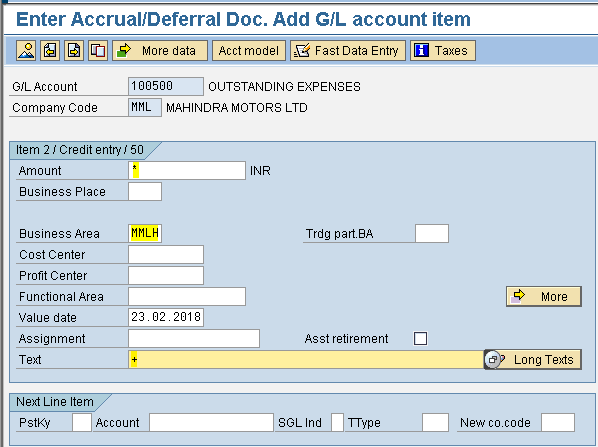

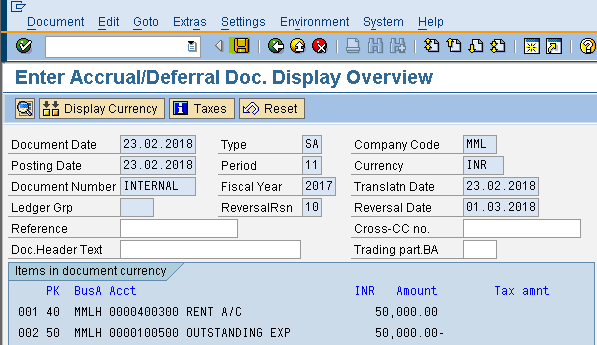

Rent Provision

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Enter Accrual/Deferral Document (Transaction code is FBS1)

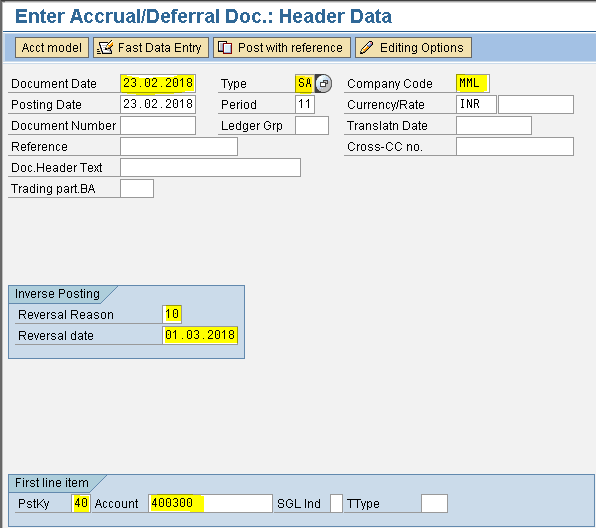

Step 1) Populate the following fields: Document date, Type, Company code, Reversal Reason, Reversal date, Posting key and Account

Press enter

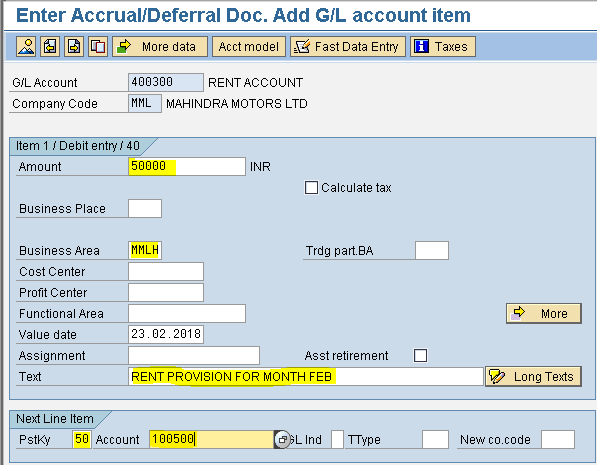

Step 2) Populate the following fields: Amount, Business area, Text, Posting key and Account

Press Enter

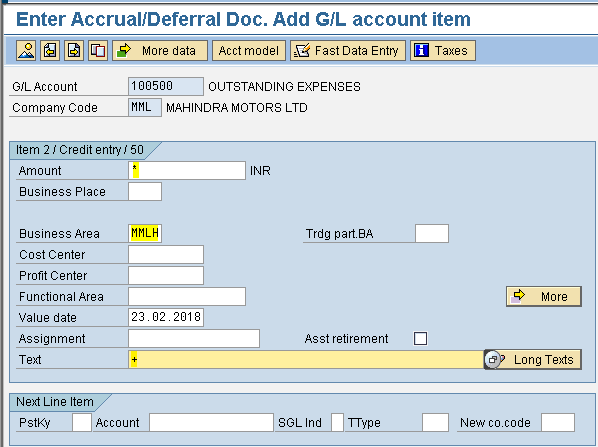

Step 3) Enter Amount, Business area and Text

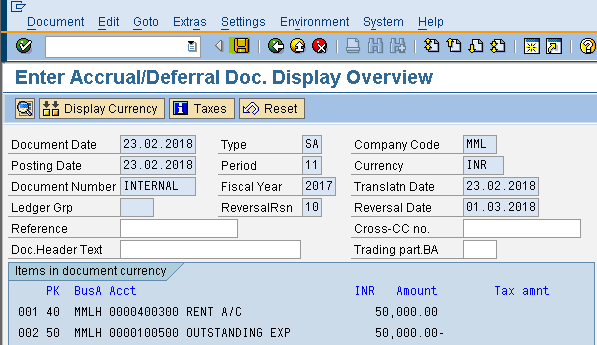

Step 4) From the menu Document - Simulate and save

We get a message below document was posted in company code MML

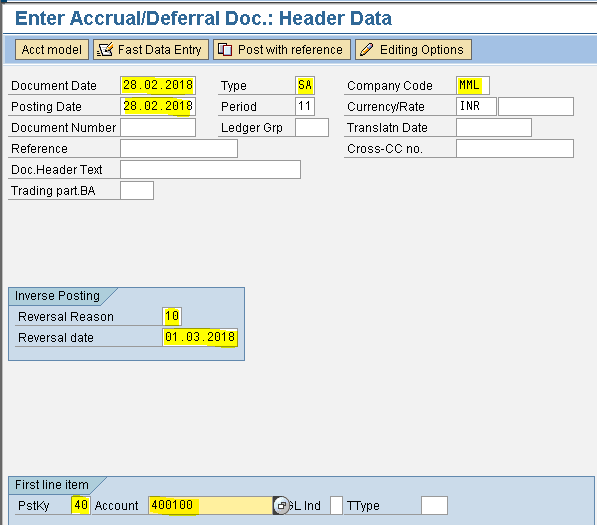

Salaries Provision

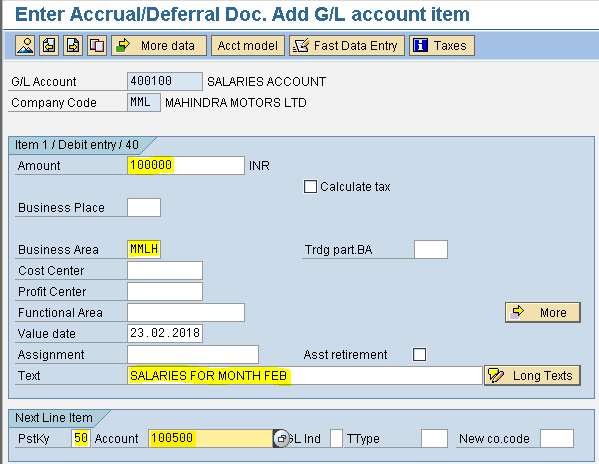

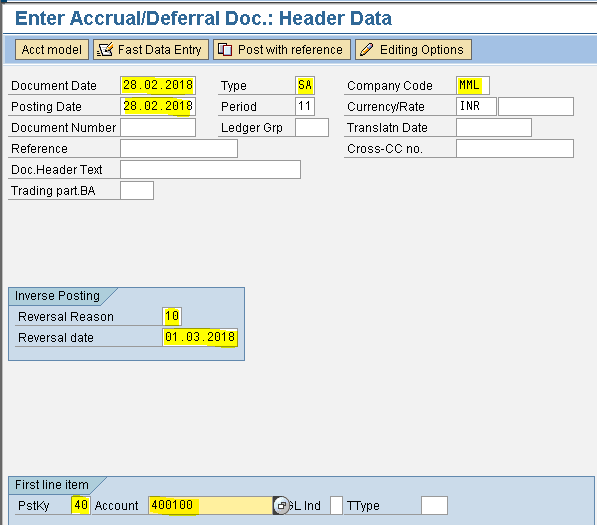

Step 1) Populate the following fields: Document date, Type, Company code, Posting date, Reversal Reason, Reversal date, Posting key and Account

Press enter

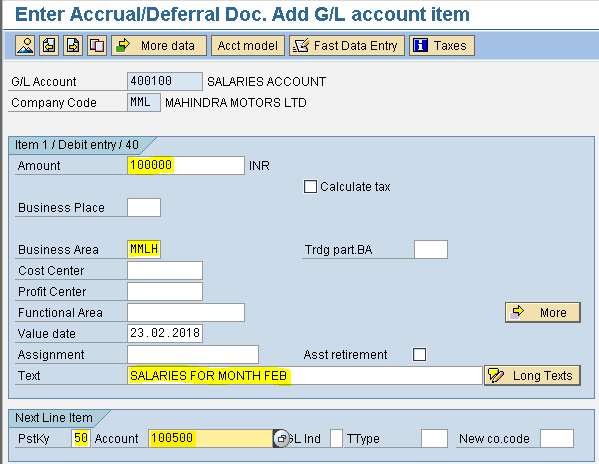

Step 2) Populate the following fields: Amount, Business area, Text, Posting key and Account

Press Enter

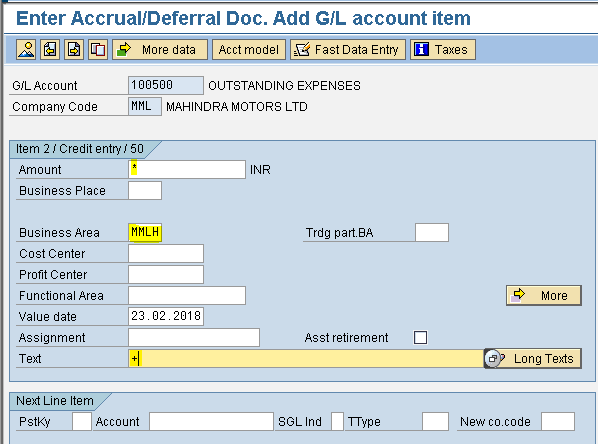

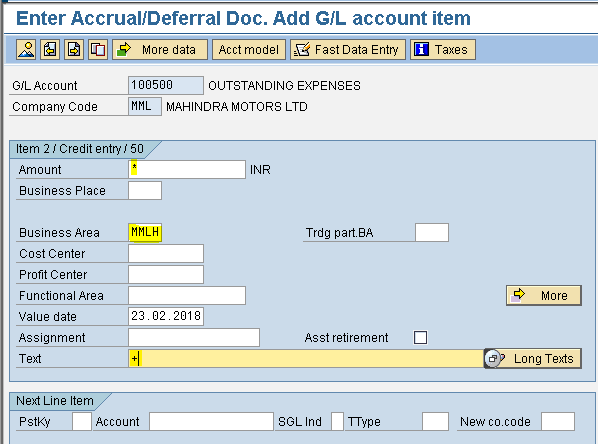

Step 3) Enter Amount, Business area and Text

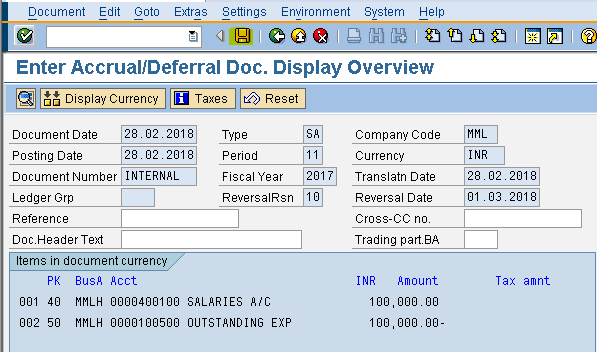

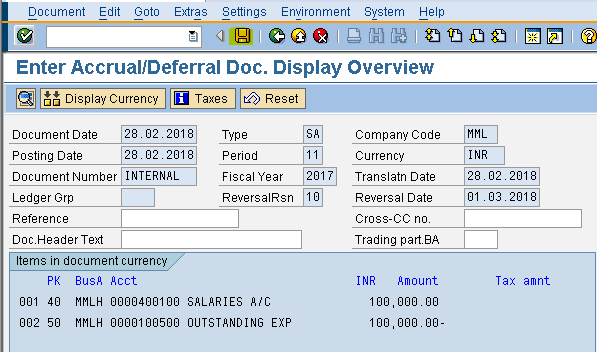

Step 4) From the menu Document - Simulate and save

We get a message below document was posted in company code MML

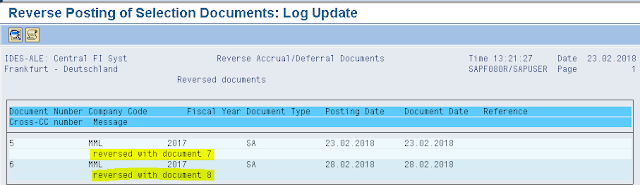

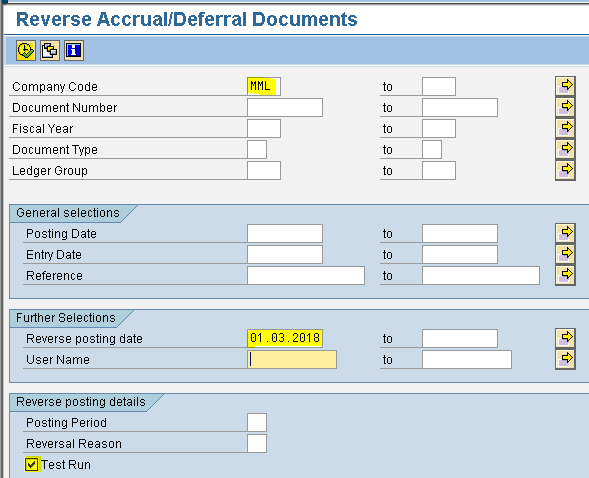

Reverse Accrual/Deferral Document

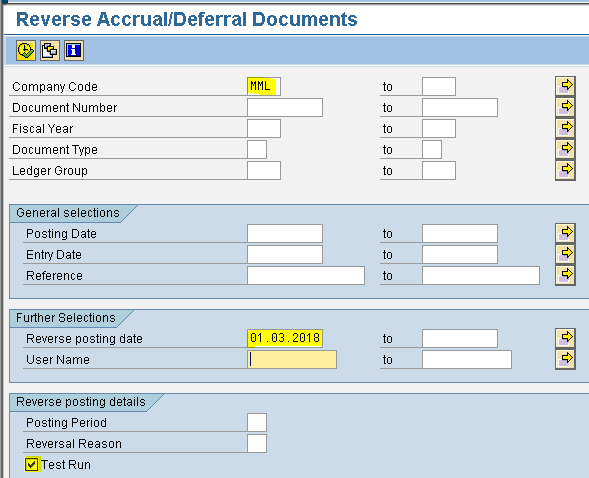

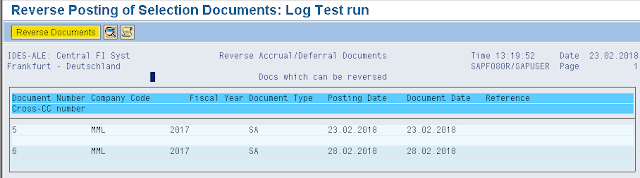

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Reverse Accrual/Deferral Document (Transaction code is F.81)

Step 1) Give the Company code and Reverse Posting date

Select the Test Run check box

Execute

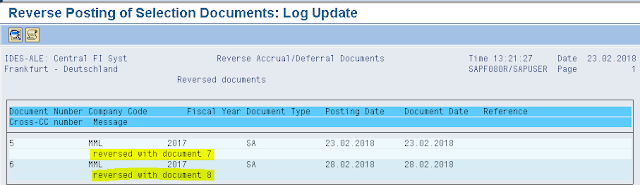

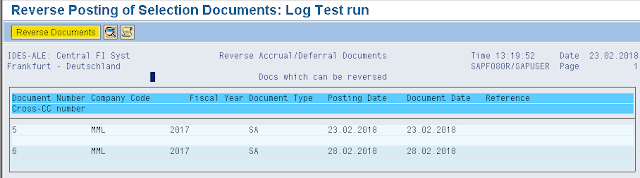

Step 2) Select Reversal Documents button in the next screen

Result:

Document 5 is reversed with document 7

Document 6 is reversed with document 8

On the month end provision are made and on the next month first working day, we reverse total provisions made. At the time of making payment we take the actual payment made.

Steps:

1) Creation of reversal reason

2) Enter accrual/deferral documents

A. Rent Provision

B. Salary Provision

3) Reversal of accrual/deferral documents

Creation of Reversal Reason

Path: SPRO - Select Sap Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Adjustment Posting/Reversal - Define Reasons for Reversal

Step 2) Populate the following fields : Reason, Text, Negative Posting and Alternate Posting date

Why we select negative posting check box?

When we reverse provision on the 1st of next month, it shows on debit side as negative balance instead of credit side

Why we select alternative posting date check box?

If we do not select the alternative posting check box, system will allow us to reverse only on original posting date. If we select the check box, it allows reversal entry on any date.

Ex:

Provision - 30/02/2018 (original posting date)

Reverse - 01/03/2018

Step 3) Select save button or Ctrl + S

Save in your request

Rent Provision

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Enter Accrual/Deferral Document (Transaction code is FBS1)

Step 1) Populate the following fields: Document date, Type, Company code, Reversal Reason, Reversal date, Posting key and Account

Press enter

Step 2) Populate the following fields: Amount, Business area, Text, Posting key and Account

Press Enter

Step 3) Enter Amount, Business area and Text

Step 4) From the menu Document - Simulate and save

We get a message below document was posted in company code MML

Step 1) Populate the following fields: Document date, Type, Company code, Posting date, Reversal Reason, Reversal date, Posting key and Account

Press enter

Step 2) Populate the following fields: Amount, Business area, Text, Posting key and Account

Press Enter

Step 3) Enter Amount, Business area and Text

Step 4) From the menu Document - Simulate and save

We get a message below document was posted in company code MML

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Reverse Accrual/Deferral Document (Transaction code is F.81)

Step 1) Give the Company code and Reverse Posting date

Select the Test Run check box

Execute

Step 2) Select Reversal Documents button in the next screen

Result:

Document 5 is reversed with document 7

Document 6 is reversed with document 8